The Economy's a Joke, and We're All the Punchline

So, the Q3 GDP report is MIA. Vanished. Poof. The official line? "Shutdown prevented data collection." Right. And I'm the Queen of England. Give me a break. They expect us to swallow that load of garbage, and frankly...

What's REALLY going on here? You don't just "lose" a GDP report. It's not like misplacing your keys or forgetting to pick up milk. This is the freaking economy we're talking about. It's the foundation of everything, or so they keep telling us.

The PPI: Our New Economic Overlord?

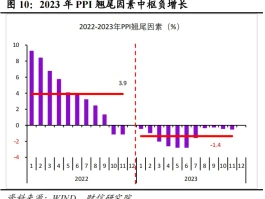

Now, suddenly, the Producer Price Index (PPI) is the belle of the ball. This ugly duckling of an economic indicator – usually overshadowed by the CPI – is now supposed to tell us everything we need to know. The PPI came in at 2.6%, which is apparently "better than expected." Markets rallied yesterday, hit resistance today. Core producer prices rise less than expected in September; headline PPI in line.

But let's be real. The PPI is just inflation at the producer level. It's like measuring the temperature of the engine while the car is careening off a cliff. Does it matter? Yeah, a little. Is it the whole story? Hell no.

And here's where my tinfoil hat starts feeling a little more comfortable. BlackRock dumped a boatload of Bitcoin right before the PPI report came out. 4,471 BTC, worth over $400 million. Coincidence? Maybe. But Occam's Razor suggests something a little more... sinister. Insider trading, anyone? When did that become legal? Oh wait. Nevermind.

Smoke and Mirrors, or Just Incompetence?

Then you've got the whispers about Trump wanting lower interest rates, so he's just burying any bad news. It's not just us, either. Germany's GDP growth is at 0%. Zero. Nada. Zilch. The global economy is looking less like a well-oiled machine and more like a clown car teetering on the edge of a ravine.

This is the first time in HISTORY that both the Jobs Report and GDP Report have been canceled at the same time. Is it incompetence, malfeasance, or just plain old-fashioned corruption? Honestly, at this point, does it even matter? The result is the same: we're flying blind.

The S&P 500 is at a "critical point." Blah blah blah. Technical analysis. Fibonacci retracement levels. All of it's just tea leaves. The market is driven by emotion, fear, and greed. Not some stupid chart. If the market soars, it'll invalidate the channel breakdown and trigger an upward movement. If it rejects, the SP500 could fall by nearly 9%. Or maybe it'll do something completely different. The one thing you can count on is uncertainty.

So What's the Play?

Honestly? I don't know. I wish I had some brilliant insight, some secret strategy to navigate this economic minefield. But I don't. All I can say is: buckle up. It's gonna be a bumpy ride. I'm just a humble columist trying to make sense of it all, and some days... I just can't.